Lawyer Billing Models, Explained: Which One Fits Your Firm?

Every law firm bills differently, but all law firm billing methods serve one purpose: enabling your firm to invoice clients accurately,...

How to Resolve Unhappy Client Situations: Effective Strategies for Lawyers

When you resolve unhappy legal clients using a consistent framework, you can protect trust and strengthen a fragile relationship.

How Small Law Firms Can Benefit From a Legal CRM

There are many benefits to having a small law firm or solo practice. Your clients have access to more personalized service...

How to Grow a Law Firm. A Practical Guide for Sustainable Success.

Growing a law firm is rarely about doing one big thing. It is about making smarter decisions across marketing, operations, finances,...

Law Firm Credit Card Guide: Rules, Fees, and Smart Setup

Accepting credit cards can improve cash flow, but law firms must follow strict ethical rules. This law firm credit card guide...

Law Firms and the Cloud: The Real Pros, Cons, and Payoff

At some point, every firm hits the same crossroads: outdated software vs. the cloud. This guide separates hype from reality, covering...

The intuitive design and robust features of CosmoLex have been a game-changer for my firm. I recommend it to any solo practitioner looking to reclaim their time.

Jonathan Roth

Founder, Roth Advocacy

Canada

Customer Centric Messaging

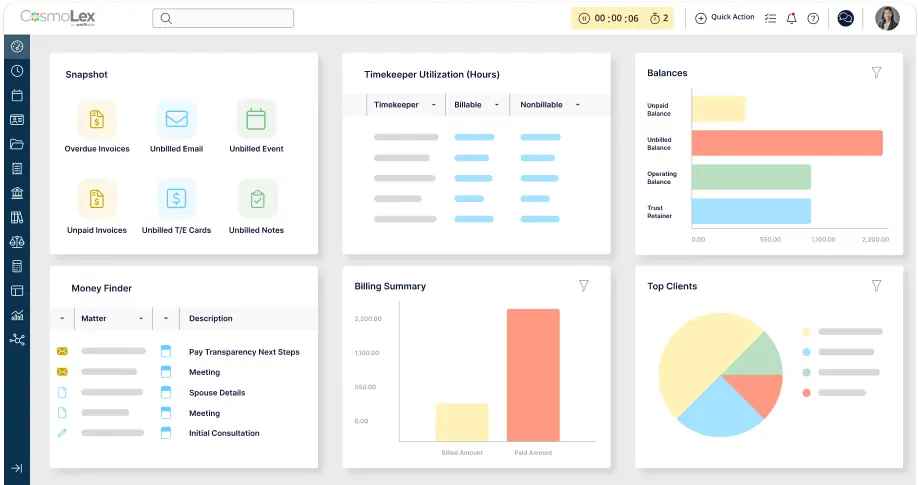

Cosmolex provides a familiar and simple user interface that allows our firm to quickly and efficiently manage billing and times.

A Practical Playbook for Running a Remote Law Firm

Running a remote law firm requires more than just working from home. Discover the essential infrastructure, security safeguards, and automated workflows...

Are Accounts Receivable an Asset?

Attorney billing increments help firms track time consistently, but they can also create manual work and errors. Learn the most common...

Attorney Billing Increments: Which One Fits Your Firm?

Choosing the right billing increments helps firms track time in a fair, consistent way while keeping invoices accurate and easy to...

What Is the Difference Between a Flat Fee Agreement and a Retainer for Law Firm Pricing?

What’s the difference between a flat fee agreement vs retainer? Learn when to use each model to optimize your law firm’s...

Law Firm Accounting Guide: What You Need to Know About Handling Client Funds

This law firm accounting guide walks you through the core areas of legal accounting to manage client funds confidently, stay compliant...

What Are the Most Common Ethics Violations for Lawyers?

What are the common ethics violations for lawyers? We break down the most frequent risks—from conflicts of interest to trust accounting...

How Much Should Your Law Firm Bill for Paralegal Work?

Law firms can bill paralegal work at market rates, increasing firm profitability. Learn how to determine the right paralegal billing rate...

What Forms of Payment Do Lawyers Accept?

If you’re hiring a lawyer, you have options for payment! Learn about the most common lawyer payment methods, from credit cards...

The Best States for Lawyers: Where to Grow Your Legal Career

Where you choose to practice law matters. From practice opportunities and salary expectations to quality of life, geography can shape everything...

Sign up for weekly tips and news from CosmoLex.

Simplify your practice with one tool.

Book a demo.

Book a personalized demo with a CosmoLex specialist and see the platform in action.